作品三十二:The Power of BVE Information Guiding Me Through My Investment Journey

Introduction:

Let’s me intro myself, I am a Chartered Accountant who qualified in UK. I left Malaysia from Sept 1999 to officially settle down back here in Apr 2019. Currently, I am Grandpine Capital marketing agent but I rest assured you that I won’t get any tips or any extra info or any special treatment from BVE coaches and some coaches do not even know me.

So, I was not familiar with KLCI counters and one day, my friend told me to attend this talk done by Mr Lok in Nov 2019. His point is very important point to me is where he emphasized that it is better to have a platform to do investment rather than alone. So, in my opinion, the power of information will be unlimited when you have a platform like BVE with a network of people rather than alone who has limited time, resources, and scopes. I will emphasis on information here coz those fundamentals like PE,PB and etc are more like secondary to me in investment journey.

My investment journey:

Then, I signed up for GIS course in Dec 2019 and through BVE, I bought the very 1st few counters like FPI, AeonCr, Wellcall and Takaful. Then came the crashed in March 2020 and during this heavy paper loss period, I managed to get assurance for once again from the BVE coaches esp from Mr Lee’s fb live.

Those BVE coaches won’t give you direct buy or sell calls but at least that information you abstract from BVE can give you clear and confidence direction in terms of investing in KLCI counters.

Around in May and July 2020, Mr Lee gave a clear macro economic guideline like overall direction where the companies will head to in future especially in this quantitative easing period by central banks. This is my most important piece of information and then, I have decided to invest my savings in Malaysia to KLCI.

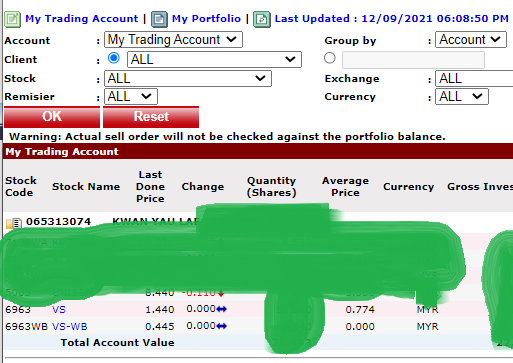

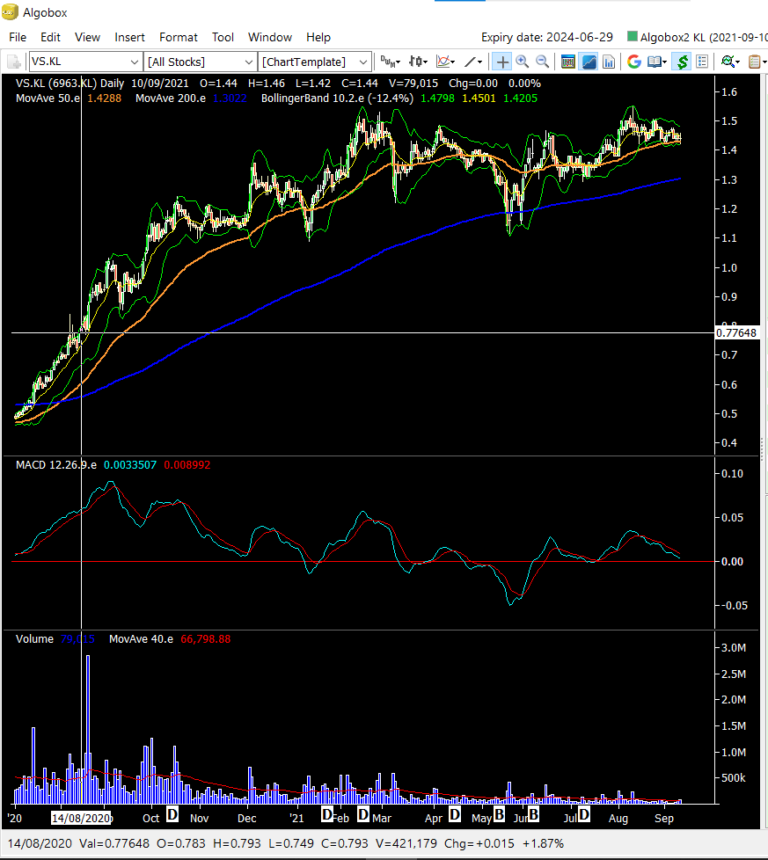

Again, this time I have looked into BVE and at the same time, Mr Lee spoke about China-US trade war which will benefits Malaysian companies due to high import taxes imposed on Chinese goods. Around in Aug 20, David released the BVE of VS industry. What so special about this BVE compared to others? This BVE got lots of evidence of booming orders with trailers parking full in the warehouse and expansion of factory plan and etc. At the same time, this period is the peak of glove counters and most of my circle of friends talking how great it was esp the growth and etc. The saying goes don’t go there when there are too many crowds. So with the BVE’s info, Mr Lee’s big environment opinion and not many trader focusing on VS Industry yet, I have made this decision to buy its share on Aug 2020. So, this is one of my successful investments.

The problem with too much information

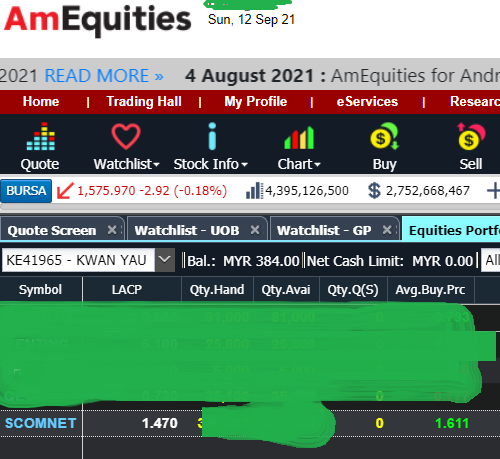

There are lots of information out given through BVE but it is down to you to filter or which part is relevant for you. It is like (天时地利人和), how you going to use it? I also cut loss few counters at the beginning especially on Bursa when I bought in at high price but this is the process we need to go through in investment journey. From this experience, we will make better judgement in future. So, with BVE, this will make an inconclusion decision on your investment but remember what is taught through BIS course, it will make you sensible in whether to top up your current investment or cut it with the given BVE information.

The repetition of strategy using BVE information

Like I say BVE won’t has buy or sell call and the final decision is made by investors themselves. This is very important so we can learn and survive in the investment journey ie not like every time being spoon-fed, then suddenly no one feeding, we stop to eat?

With the previous experience in VS industry and I have another fund available in Apr 21, I hope I can use the same strategy. This time, I already monitored those companies through BVE from last year in 2020. This Scomnet has caught my attention in BVE but this company already rose from 0.30+ to 2.20+ so I tried to find more information about it. At that time, in Nov 2020, I heard rumors this is like another company with some fundamental but being goreng until high price. But, I never gave up on it and tried to find more information on it which took me more than 5 months before I started to buy it.

This time, it happened that my continuous participation in this BIS fact find group created by Grandpine after graduated from GIS course, has been fruitful coz in this group, I found a friend who is living in the same area of Scomnet and at the same time, he knew someone in Scomnet. So, from here onwards, I have been close contact with him to verify that information available on BVE and he also shared lots of additional information to me. Also, with Mr. Lee’s macro opinions, I have decided to invest in those inflation-hedged companies to counter inflation and this company already met my requirement. This time, when the price was corrected to below my target price and with my fund available, I started to buy it with around 36 transactions over a period and price. Now, I am closely monitoring Scomnet and hopefully will be another VS industry success story.

Conclusion:

Even with BVE information, you need to be fluid and agile in investment like the earth won’t stop rotating. With VS and this current company, when I bought it at the beginning, I also suffered paper loss over a period. All this is part of the learning process, and this will never be ending for me like the old Chinese saying (活到老学到老). Also, opportunities are always there as I am a believer of (天时地利人和) and in my opinion BVE will make this easier to achieve.